From Bryan Hoch:

Clarke Schmidt had won three consecutive starts and was coming off the most brilliant performance of his young career, an eight-inning gem against the Twins last Thursday. Yet as he stood on the Yankee Stadium mound on Tuesday evening, the right-hander looked up with shock at a rapidly growing pitch count.

The Mariners seemed ready to pounce all night, beginning with the first of Dylan Moore’s two homers, which helped send Schmidt to an early exit in the Yankees’ 6-3 loss. With a few hours to mull the situation, Schmidt said that he suspects there’s a reason why Seattle was on the attack.

“Since you brought it up, when you go back and look at the video, I think there was a little bit of relaying the signs at second,” Schmidt said.

When Moore’s third-inning homer ended Schmidt’s career-best 17 2/3-inning scoreless streak, the runner at second base was Josh Rojas, who had reached on a one-out double.

Schmidt said that Rojas may have been able to identify his pitch selection through his glove, just before Moore sent a 93.1 cutter on the outside corner into the left-field seats.

“It was a quality pitch, for sure,” Schmidt said. “Tipping is a part of this game, and it’s always in the back of our heads. It’s something that we’re well aware of. I think [Rojas] was definitely probably relaying some signs there at second. Obviously, it paid off for them.”

Schmidt said he was provided with a video of his tipped pitches after the inning and was able to correct the issue, keeping Seattle off the scoreboard for the rest of his outing. It’s not a new development for Schmidt, who said he’ll continue working to mask his pitches for his next start.

“Overall, I think the outing went well, but it’s a small factor that can really change an outing,” Schmidt said. “I’m definitely going to make adjustments and be learning from it.”

Well, you know, how about not doing that?

Also, I love that a game they lost 6-3 has the headline about Schmidt adjusting to the pitch-tipping. He still labored through five innings AFTER the pitch-tipping!

But whatever, once again, the offense stalled, and while the bullpen was bad (and Aaron Boone clearly seemed to be prepared to use Clayton Andrews in a 4-0 game, and when it was suddenly 4-3, he decided to stick with his original plan, which seemed quite ill-considered), the offense annoyed me more. Not against Woo. That dude is just a really good pitcher, but the Yankees should have done more once they got within a run.

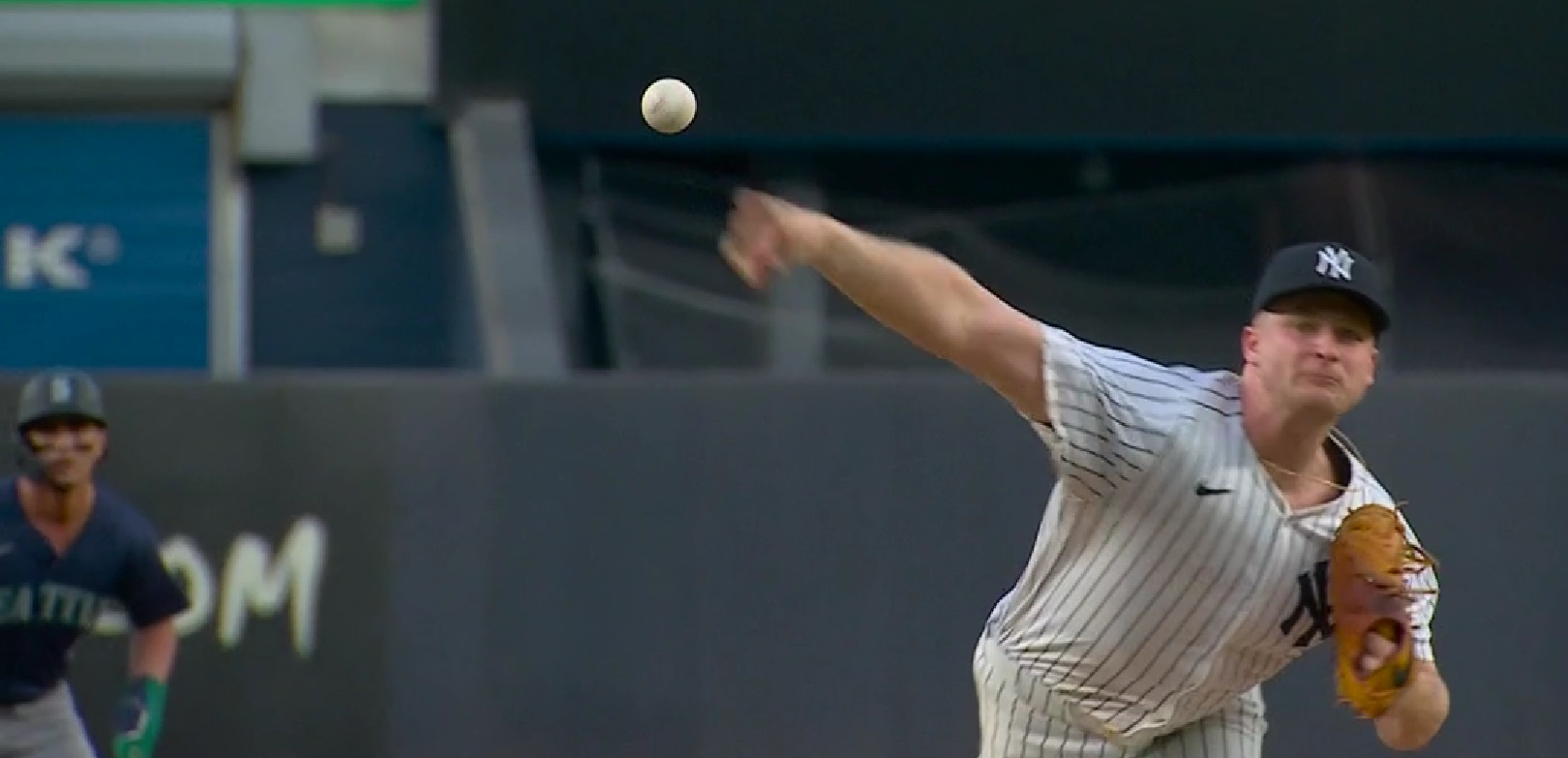

Ah well. The featured image is Schmidt throwing the pitch that Moore was tipped to by Rojas (in the back of the image).

Trent Grisham with the lowest BA .056 of any MLB player with at least 45 PAs.

Martian 0/4, 0/8 in AA. He’s got time.

Yankees owner Hal Steinbrenner warns of lower payrolls after 2024: ‘Simply not sustainable for us financially’

https://www.cbssports.com/mlb/news/yankees-owner-hal-steinbrenner-warns-of-lower-payrolls-after-2024-simply-not-sustainable-for-us-financially/

There is only one team I know of that posts it’s financial numbers publicly.

The Braves showed income of:

2016 $262 million

2017 $386 million

2018 $442 million

2019 $476 million

2020 $178 million

2021 $568 million

2022 $589 million

2023 $641 million

2020 was the pandemic season with no fans at the ballparks, 2021 was their World Series winning season, last year was their first year over $600 million.

The Braves posted an operating loss of $46 million for 2023, and the same article that all these numbers come from quotes the CEO of Braves Holdings as “thrilled” with the financial performance of the team.

Of the $641 million in revenue last year $161 million came from broadcasting. So $380 million from tickets, merch, and concessions.

The article also mentions the Braves had 39k in average tickets sold per game in 2023, but suggests only 32k in attendance for each game. The Yankees had average of 40k in tickets sold each game in 2023.

If you have $80 million in profit at the end of the season and you then decide to pay the team owner $100 million I guess that’s how you show an operating loss of $20 million, that’s not hard.

I feel like this is a Fangraphs article. Here’s an idea, and a bunch of statistics…which lead us to no conclusion about the idea.

I suppose it’s not that hard to fail to profit on $641 million in revenue on a baseball team, these books are reviewed by the SEC, they must be accurate at some level. It sure would be nice to know how much the Braves are paying to executives and ownership to come up with that loss.

Hal may be paying himself $100 million and thinking he needs a raise.

Good post. Maybe it’s his opening gambit vs Boras on Soto.

I don’t believe that the SEC reviews MLB teams books. I believe there needs to be 2000 shareholders before they have any authority.

Nice job Cards, sweeping 3 games from the O’s. Yankees, get back in the win column now.